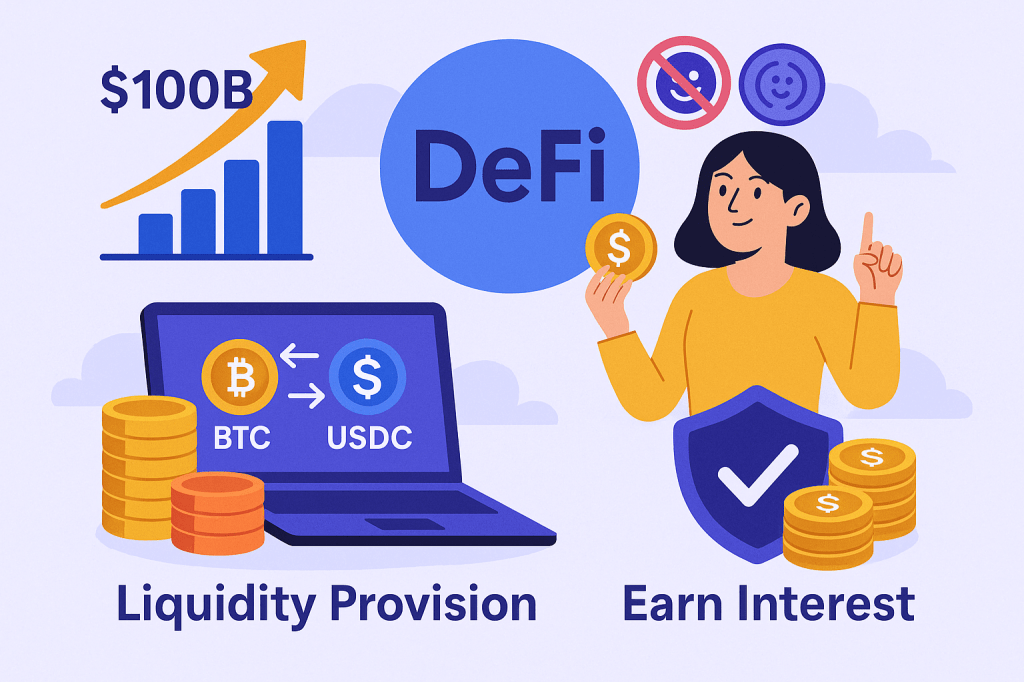

Why Most Crypto Investors Are Missing the $100B DeFi Opportunity

Let’s face it. Too many crypto investors are chasing the next meme coin, hoping it will moon. But behind the noise, there’s a quiet wealth shift happening in decentralized finance, or DeFi. It’s already moving over $100 billion, and most of that value is being captured by investors who aren’t trying to gamble on hype coins. They’re earning real returns by providing liquidity to decentralized exchanges. The best part? With platforms like CoverMax, you can protect your digital assets and still earn interest while you do it.

What Is DeFi and Why It Matters

DeFi, or decentralized finance, is basically what it sounds like: financial services that run on blockchain networks without banks or middlemen. It lets anyone lend, borrow, trade or earn by using smart contracts on platforms like Ethereum and Solana.

- Growth You Can’t Ignore: DeFi has surged from $15 billion to over $100 billion in total value locked (TVL) .

- Not Just Hype: Unlike meme coins, DeFi projects offer real utility and are the foundation of crypto’s future.

And here’s the kicker. Most of the meme coins you hear about? They trade on the same platforms powered by DeFi liquidity. So while others gamble, smart investors earn fees from their trades.

How Liquidity Provision Works

Liquidity provision means putting your tokens into a pool on a decentralized exchange (DEX) like Uniswap or Orca. These pools are what let people swap between tokens without a centralized exchange.

As a liquidity provider, you earn a small fee every time someone uses the pool. Think of it like being the house in a casino — you get paid when others trade.

- Uniswap: $5 billion in liquidity, $5.3 million in daily fees

- Radium: $1.7 billion, $6.5 million daily fees

And yes, retail investors can take part — no massive bankroll needed.

Where CoverMax Fits In

Here’s where CoverMax takes it to the next level. When you provide liquidity, you’re exposed to market swings. If something goes wrong — a protocol fails or a hack happens — CoverMax automatically protects your assets. There’s no need to submit claims or read confusing policies. Just deposit, earn, and stay protected.

- Automatic payouts: If something breaks, you’re covered instantly.

- Earn interest: Your assets don’t just sit idle. You earn even while they’re protected.

- Unified protection: One platform, one smart layer of security across all your DeFi strategies.

Debunking the Risk Myths

Yes, there are risks in DeFi. But let’s break them down:

- Impermanent Loss: Happens when the price of tokens in a pair moves apart. But it’s often offset by the fees you earn.

- Fake APRs: Pools with flashy APR numbers often involve tokens that crash. Stick with blue-chip assets and stablecoins to stay grounded.

CoverMax helps lower your overall exposure while you keep earning. That’s what we call smart yield.

How to Get Started with Liquidity Provision and CoverMax

- Pick the right platform: Go with trusted DEXs like Uniswap, Radium, or Orca.

- Select your pool: Choose pairs like SOL/USDC or BTC/SOL. These are stable and high-volume.

- Provide liquidity: Deposit equal values of each token in your selected pool.

- Connect to CoverMax: Secure your assets and start earning passive returns with full protection.

Bonus tip: Some DEXs let you stake your LP tokens for extra rewards. CoverMax still protects your assets even when staked.

Conclusion: Don’t Miss the Shift

DeFi is not just another crypto trend — it’s a structural shift in how finance works. And liquidity providers are at the heart of it. They aren’t chasing meme coin pumps. They’re earning real yield. Now, with CoverMax, you don’t have to choose between protection and profit. You get both.

The $100 billion opportunity is already here. The only question is, will you let it pass or will you be part of the smart money movement?

Leave a comment